All Categories

Featured

Table of Contents

Level term life insurance policy is among the cheapest protection alternatives on the marketplace since it supplies fundamental security in the kind of death advantage and just lasts for a set amount of time. At the end of the term, it expires. Whole life insurance policy, on the various other hand, is significantly much more pricey than level term life since it does not run out and comes with a cash money worth attribute.

Rates might vary by insurance firm, term, protection amount, health and wellness course, and state. Not all policies are readily available in all states. Rate illustration legitimate as of 10/01/2024. Level term is a great life insurance policy choice for most individuals, however depending upon your insurance coverage requirements and individual circumstance, it could not be the ideal fit for you.

How long does Tax Benefits Of Level Term Life Insurance coverage last?

Annual eco-friendly term life insurance policy has a regard to just one year and can be restored each year. Yearly sustainable term life premiums are originally less than degree term life costs, however costs rise each time you restore. This can be an excellent choice if you, as an example, have simply give up cigarette smoking and require to wait two or three years to request a degree term plan and be eligible for a reduced price.

, your death advantage payment will certainly decrease over time, however your repayments will stay the very same. On the various other hand, you'll pay more ahead of time for much less coverage with a raising term life plan than with a degree term life plan. If you're not sure which type of policy is best for you, working with an independent broker can aid.

Level Term Life Insurance For Young Adults

As soon as you have actually chosen that degree term is ideal for you, the next step is to acquire your policy. Below's just how to do it. Determine just how much life insurance policy you need Your protection quantity need to provide for your family members's long-lasting economic demands, consisting of the loss of your income in the occasion of your fatality, as well as debts and day-to-day expenses.

As you seek means to secure your monetary future, you've most likely encountered a broad selection of life insurance policy alternatives. Selecting the ideal insurance coverage is a huge choice. You want to discover something that will certainly aid sustain your enjoyed ones or the reasons vital to you if something takes place to you.

Lots of individuals lean towards term life insurance policy for its simpleness and cost-effectiveness. Degree term insurance coverage, nonetheless, is a type of term life insurance policy that has regular settlements and a constant.

What is included in 20-year Level Term Life Insurance coverage?

Degree term life insurance policy is a part of It's called "level" due to the fact that your premiums and the advantage to be paid to your liked ones remain the very same throughout the contract. You will not see any adjustments in expense or be left questioning its worth. Some contracts, such as yearly sustainable term, might be structured with costs that enhance with time as the insured ages.

Repaired fatality advantage. This is also established at the beginning, so you can recognize exactly what death benefit amount your can expect when you pass away, as long as you're covered and current on premiums.

How can Term Life Insurance With Fixed Premiums protect my family?

This usually in between 10 and three decades. You consent to a set premium and survivor benefit for the duration of the term. If you pass away while covered, your survivor benefit will certainly be paid to liked ones (as long as your costs depend on date). Your recipients will recognize beforehand exactly how a lot they'll obtain, which can help for planning purposes and bring them some economic protection.

You might have the option to for one more term or, most likely, restore it year to year. If your contract has actually an assured renewability provision, you may not need to have a new medical examination to keep your protection going. Nevertheless, your costs are likely to boost because they'll be based upon your age at revival time. Best level term life insurance.

With this choice, you can that will last the rest of your life. In this case, again, you may not require to have any type of brand-new clinical examinations, however premiums likely will increase because of your age and new insurance coverage. Various firms offer different choices for conversion, be sure to understand your options prior to taking this step.

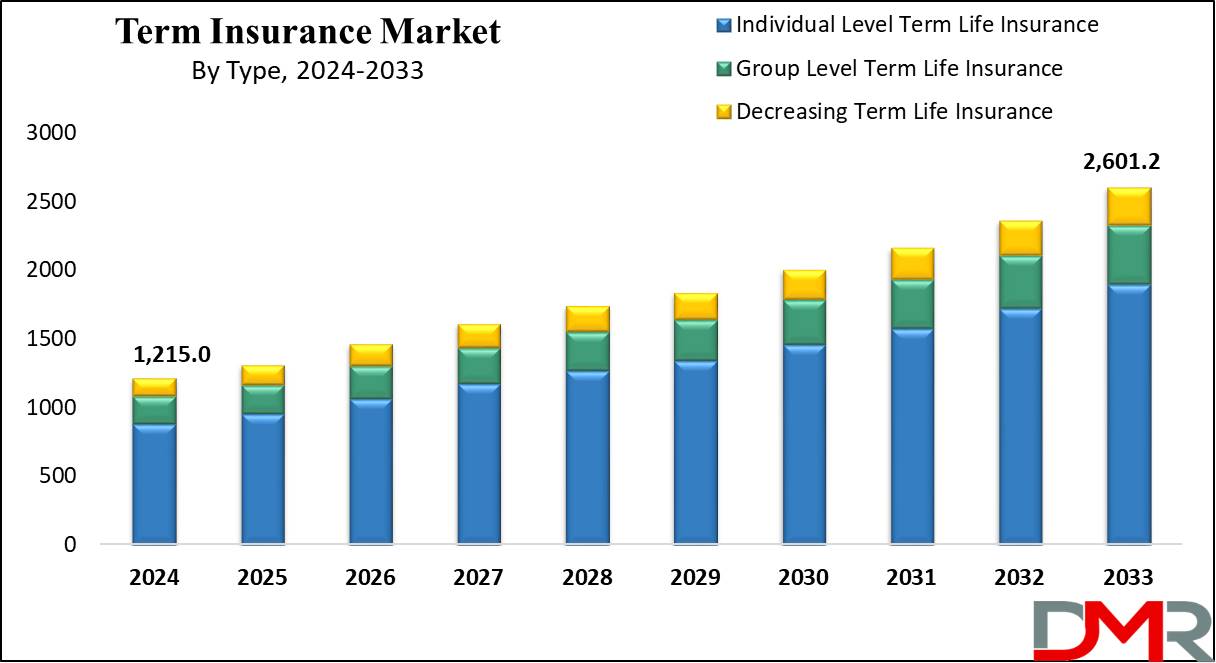

Consulting with a monetary consultant additionally might aid you determine the course that straightens finest with your general technique. Most term life insurance policy is level term for the duration of the contract duration, however not all. Some term insurance may come with a premium that enhances with time. With reducing term life insurance policy, your survivor benefit drops in time (this kind is frequently taken out to especially cover a long-term financial obligation you're repaying).

Low Cost Level Term Life Insurance

And if you're established up for sustainable term life, after that your costs likely will rise every year. If you're checking out term life insurance policy and intend to guarantee straightforward and foreseeable economic protection for your household, level term might be something to consider. As with any type of insurance coverage, it might have some limitations that don't satisfy your demands.

Usually, term life insurance is extra budget friendly than permanent coverage, so it's a cost-effective way to secure economic protection. At the end of your contract's term, you have multiple alternatives to continue or relocate on from protection, often without needing a clinical exam (20-year level term life insurance).

What does Level Term Life Insurance Coverage cover?

As with various other kinds of term life insurance coverage, as soon as the contract finishes, you'll likely pay greater premiums for protection due to the fact that it will recalculate at your current age and health and wellness. Degree term supplies predictability.

However that doesn't imply it's a suitable for everybody. As you're going shopping for life insurance coverage, here are a few key factors to take into consideration: Spending plan. Among the benefits of degree term coverage is you understand the price and the survivor benefit upfront, making it easier to without stressing over increases over time.

Age and wellness. Typically, with life insurance policy, the much healthier and more youthful you are, the a lot more cost effective the protection. If you're young and healthy and balanced, it may be an appealing alternative to secure low premiums now. Financial responsibility. Your dependents and financial responsibility contribute in determining your coverage. If you have a young household, as an example, level term can aid supply financial backing during critical years without paying for coverage longer than essential.

Latest Posts

Final Expense Insurance To Age 90

Final Expense Insurance For Cancer Patients

Term Life Insurance Instant